This site uses cookies to improve the user experience. If you need more information or want to change settings, click here

Sustainability

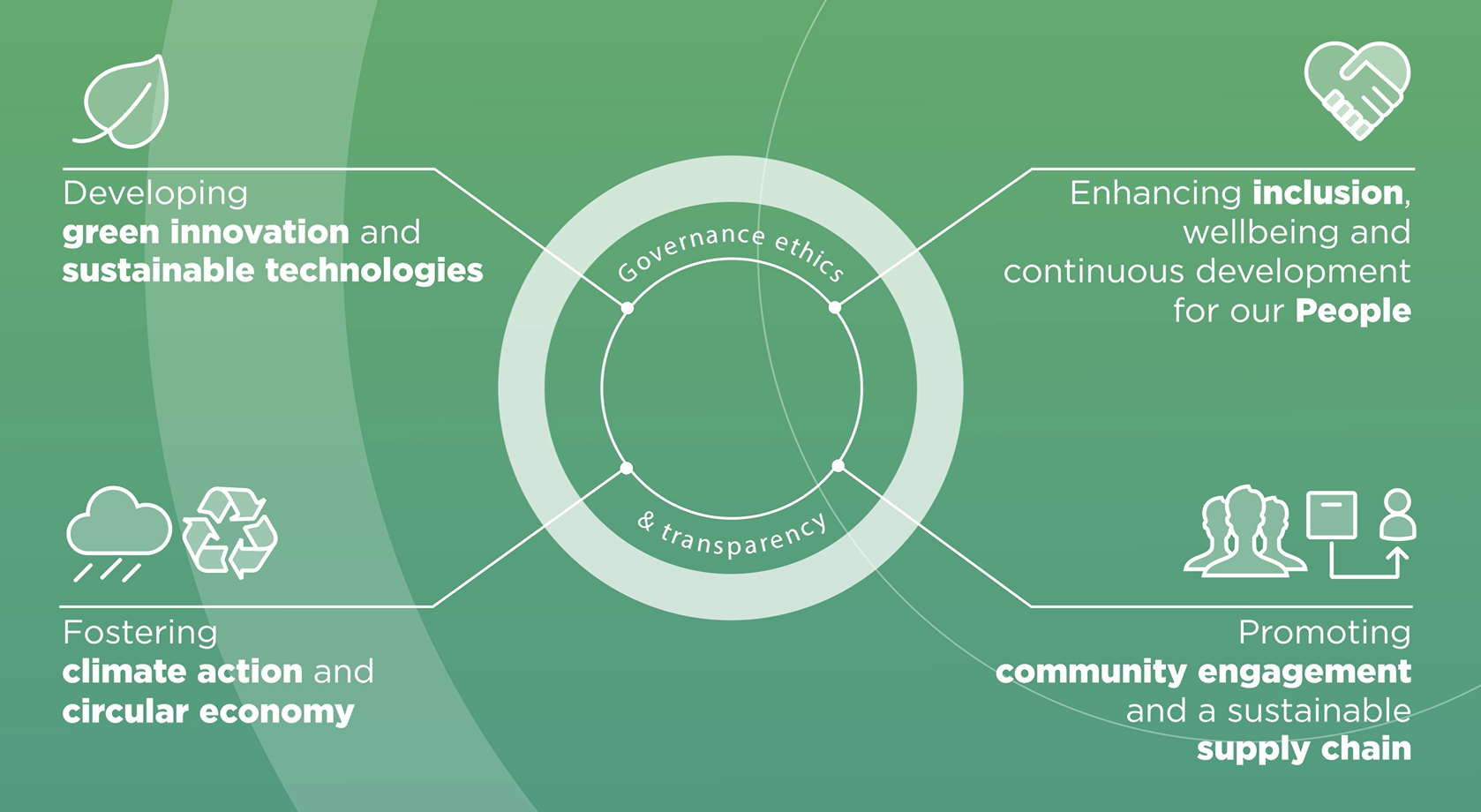

Sustainability is in our DNA. We provide clean, sustainable, and innovative technological solutions while promoting a circular economy with engaged people who are eager to make a difference.

In particular, the company has been engaged in the development of innovative technological solutions, such as the new Small Scale electrolyzer, Dragonfly®, dedicated to green hydrogen generation and launched in 2024. It also continued to invest in R&D activities aimed at evolving its sustainable technology portfolio, which to date includes 278 patent families and more than 2,800 territorial extensions. Finally, the company has expanded and optimized its production capacity, across different business segments, involving plants in China, Japan, and Germany, between the end of 2023 and the beginning of 2024.

In Italy, work continues on our Gigafactory, one of the biggest plants in Europe, which will start its operations in 2026. When fully operational, the plant, which has been granted IPCEI funds from the Ministry of Enterprise and Made in Italy in the form of an expenditure grant, will have a dedicated production capacity for green hydrogen technologies of 2 GW. In addition, the site will house systems related to our traditional segments (Electrode Technologies and Water Technologies), optimizing the production set-up in the country.

With a view to developing new technologies and strengthening business relationships, De Nora has signed new strategic partnerships with leading international players in different geographical areas, such as Asahi Kasei in Asia, Acwa Power and Saudi Water Authority in the Middle East.

Meanwhile, the Group’s global organization has continued to evolve, and our headcount now exceeds 2,000, with a balanced presence in different geographical areas.

Based on clear leadership in the segments in which it operates and the rich diversification of end-user markets, the Group’s business model has proven resilient through 2024. Up 2.6% at constant exchange rates, revenue increase as supported by all business segments and in particular by the Water Technologies segment, driven by the brisk recovery in the Pools line with a growth of 15%, and Energy Transition, supported by a solid portfolio of flagship projects at international level for Green Hydrogen production: NEOM in the Middle East and STEGRA in northern Europe. The adjusted EBIDTA margin stood at 18%, compared to the guidance for the year of 17%.

New orders acquired during the year exceeded Euro 800 million, 15% up year-on-year, thanks in particular to the development of the Water Technologies and Energy Transition segments and the good performance of the Electrode Technologies segment, providing visibility for 2025 revenues.

During 2024, De Nora initiated the execution of the Sustainability Plan to 2030 approved in December 2023, and aimed at generating sustainable value and positive impacts throughout the value chain. All the activities and initiatives planned for the 2024 financial year have been completed: from the introduction of Circular Design Guidance in R&D processes, to the definition of Sustainability Scorecards to be applied to all our products by 2027, to the definition of Decarbonization Plans for our production facilities in the different geographical areas, and finally, the adoption of a policy related to Diversity Equity and Inclusion issues.

In addition, after a careful analysis of the Group’s historical data, a number of new quantitative targets have been set, such as the percentage of women in new hires in the next three years, at 40%, and the percentage of waste to be recycled by 2030, at 55%. De Nora continued to build plants for self-generation of energy from renewable sources, through the installation of photovoltaic panels at various production sites, reaching an installed total capacity of about 3.6 GWh at the plants in Germany, Italy and Brazil by the end of 2024. Energy from renewable sources, used at the Group level, reached an incidence of 29% in 2024, up from 3% in 2023, supporting an overall reduction in emissions (Scope 1 and 2) of about 15% compared to 2022.

De Nora’s clear commitment has been accredited by various ratings and external recognitions. In particular, MSCI, a leading global ESG rating agency, has confirmed an AA rating for De Nora. For the second consecutive year, we have received the Great Place to Work recognition in Italy. Additionally, the rating agency Morningstar Sustainalytics has assigned De Nora an ESG risk rating of 22.2, in line with the main reference peers. Finally, De Nora has obtained validation of its climate targets, related to the reduction of greenhouse gas emissions by 2030, from the Science Based Target initiative (SBTi).

Considering the market outlook, in 2024 the global macroeconomic and geopolitical scenario exhibited many of instability and uncertainty factors, which could persist through 2025. At geopolitical level, the escalation of some conflicts in different parts of the world has contributed to a global tension climate. On the economic front, rising interest rates have slowed some investment decisions in capital intensive sectors, such as Clean Tech.

In addition, the political evolution of individual countries played a crucial role.

The USA presidential election is affecting several economic sectors, such as, for example, the regulation dedicated to the development of clean technologies, with particular reference to Chapter 45V of the Inflation Reduction Act (IRA), which is responsible for supporting the overseas development of low-carbon hydrogen.

Despite this, the prospects of the target markets related to our core businesses related to water treatment, chlorine production, electronics, and nonferrous metal refining remain intact and our strong positioning makes us confident in our performance for the coming years.

On the other hand, the green hydrogen market (which will play a key role in the decarbonization processes of hard-to-abate sectors in the medium term, with significant growth prospects expected in the medium to long term) presents a short-term scenario that remains uncertain, due to several factors, including delays in the definition of national and international regulations to support the market, resulting in slowdowns in final investment decisions (FID) related to green hydrogen projects. The sector development requires greater clarity and certainty in regulatory frameworks, and their related forms of subsidy, particularly in those geographical areas where the overall cost of producing green hydrogen is not yet competitive with respect to hydrogen produced from hydrocarbons. To date, based on projects that have already reached the Final Investment Decision (FID) and those planned at global level, it is expected that by 2030 the installed generation capacity will be about 30 GW; on the other hand, an acceleration in the development of regulations to support the market in both Europe and America could increase this forecast up to 100 GW.

De Nora remains committed to the development of technologies for green hydrogen generation and broader energy transition, maintaining a preferred competitive positioning supported by its proximity to traditional businesses.

The challenges that await us in the coming years relative to the implementation of industrial plans within our business segments are inevitably demanding. Optimal and flexible investment management, careful evaluation of operating costs, and initiatives aimed at revenues growth represent targets consistent with our ambition to be a leader in sustainable technologies, electrochemistry, and water treatment, which we intend to continue to pursue by teaming up with all stakeholders and always putting our people at the center.

- Paolo Dellachà, CEO